Exclusive: the Great British car insurance write-off scandal - insurers work with DVLA to close gaps

On the back of our exclusive investigation, organisations are now collaborating to find ‘missing’ damage-repaired cars

The car insurance industry is working with the Driver and Vehicle Licensing Agency (DVLA) to close database gaps that allow written-offs cars to pass history checks with a clean bill of health.

In March this year, we discovered that the crash-damaged history of a number of cars sold at salvage auction as Cat S and Cat N write-offs was not being detected by provenance checks run by HPI and Experian.

Now the Motor Insurers’ Bureau (MIB) says it is working with the DVLA, which holds a more comprehensive database of write-offs, to tackle this issue. The MIB admits it didn’t know the true scale of the problem – which affects tens of thousands of vehicles a year – until Auto Express highlighted the problem.

• How to save money on your car insurance

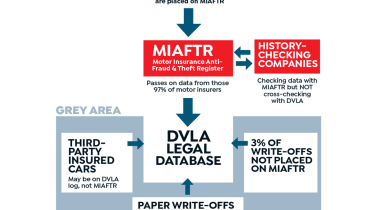

The issue relates to a database called the Motor Insurance Anti Fraud and Theft Register (MIAFTR), which is run by the MIB. It’s used by HPI and Experian to determine if a car has been written off.

During the 2016/17 and 2017/18 financial years, however, 168,000 fewer written-off vehicles were put on MIAFTR compared with the DVLA’s database of repairable write-offs. It is unlikely these vehicles, if put back on the road, would be detected as such by provenance checks.

“We knew there were gaps. But no, we didn’t understand the true scale of it”, Ben Fletcher, the MIB’s chief customer officer, told Auto Express. “Since the article ran, and as part of our general work, we have engaged with the DVLA and we are actively talking to them about what the size of the gap is between the two [databases], and is there an opportunity to close that gap by sharing information?” He said discussions with the DVLA are in “early stages” but have been ongoing “for the last couple of months”.

Fletcher explained that MIAFTR “was set up a long time ago by insurers... to share information about the history of the cars they were insuring. At some part in its history... the likes of HPI and Experian said ‘Can we have access to this data? Because this data is one part of a component that will help for our vehicle provenance checks’: It’s being used to help provide a product, but MIAFTR was never designed to be a definitive register of every vehicle which has been damaged beyond repair.”

The MIB confirmed HPI and Experian are the only two provenance companies with access to MIAFTR, with other history-checkers using data provided by these two firms.

Fletcher added: “The people providing the vehicle provenance checks understand the issues. They provide guarantees in the circumstances where there is a problem.”

How do these gaps appear?

There are a number of reasons for vehicles not to be on MIAFTR. Cars with third-party cover that aren’t declared ‘total losses’ can be missing, as can cars written off using paper records. The MIB also says fleet operators with large excesses may buy a new car rather than claim a total loss; these cars can also be missing. If such a vehicle is subsequently repaired, provenance checks may not detect its true history.

What do the other organisations say?

DVLA: It confirmed discussions with the MIB over these issues. We asked why the organisation can’t simply open its write-off database to third-party companies like HPI and Experian, given that private parking firms can access other DVLA datasets. The organisation simply said there are “no plans” to do this.

HPI: It “works tirelessly to improve the coverage and accuracy of its data and is carrying out increasingly more checks year on year, and as such is identifying a growing number of vehicles hitting the register as write-offs”. The firm highlighted that buyers are protected by a guarantee of up to £30,000 if it supplies inaccurate or incomplete information; however, this guarantee is capped at £15,000 if it’s discovered that a vehicle has been written-off.

Experian: Its position on the subject hasn’t changed since March, when the firm said it “will continue to work with our data and insurance industry partners” to “establish the circumstances” behind the vehicles highlighted in our article.

Crashed cars written-off by insurers are being repaired and sold to unsuspecting motorists

Cars that have been deemed insurance write-offs following serious accidents are passing vehicle history checks with a clean bill of health and being sold to unsuspecting motorists, Auto Express can exclusively reveal.

Vehicle history checks are relied on by countless buyers every year to reveal whether a car is subject to outstanding finance, has mileage irregularities, has been stolen, has previously been scrapped or has been deemed an insurance write-off.

But the damaged cars you see in these photographs were sold at a salvage auction, having been classified as ‘Cat S’ – meaning they were written off after sustaining serious, structural accident damage, and were only allowed back on the road after having been properly repaired.

Despite this, all of these models passed the vehicle history checks offered by both HPI and Experian AutoCheck, and were being marketed to consumers as never having been written off.

We found 10 cars that had been sold at a salvage auction as declared Cat S write-offs, making a note of the VIN plates displayed in the salvage listings. We paid for HPI and Experian AutoCheck history checks, cross-referencing VINs and registration plates with the reports. Some of the cars generated alerts for outstanding finance or mileage discrepancies, but not one check from either HPI or Experian flagged any of these cars as an insurance write-off.

Auto Express was alerted to this issue by a reader who uncovered inconsistencies with history-checking companies after buying a used car he discovered had previously been sold via a salvage auction. As well as a conventional history check, the reader used a company called www.vcheck.uk, which crosschecks a car’s write-off status against salvage auction records.

After we learned of this problem, we contacted vcheck and were provided with a number of cars that had raised similar concerns.

Insurance write-offs for sale with clear history checks: examples

2016 Renault Captur 1.5 dCi

Auctioned as a write-off This Renault Captur was auctioned as a Cat S write-off in February 2018 with significant front-end damage. Its odometer read 12,957 and it was listed with a suggested retail value of £12,370.

On sale 13 months laterBy March 2019 this Captur had been repaired and was advertised with 17,000 miles for £9,750. HPI and Experian checks did not reveal its write-off history.

2015 Toyota Yaris Icon Hybrid

Auctioned as a write-offThis Toyota Yaris was auctioned as a Cat S write-off in August 2018 with significant front-end damage and a suggested retail value of £9,330.

On sale nine months laterBy March 2019 this Yaris had been repaired and was advertised for sale to consumers for £8,995. HPI and Experian checks did not reveal its write-off history.

2014 Ford B-MAX 1.4

Auctioned as a write-offThis Ford B-MAX was auctioned as a Cat S write-off in July 2018 with significant front-end damage and a suggested retail price of £7,400.

On sale eight months laterBy March 2019 this B-MAX had been repaired and was advertised for sale to consumers for £6,490. HPI and Experian checks we performed did not reveal its write-off history.

2012 Skoda Superb 2.0 TDI Elegance

Auctioned as a write-offThis Skoda Superb was auctioned as a Cat S write-off in June 2018 with significant front-end damage.

On sale nine months laterBy March 2019 this Superb had been repaired and was advertised for sale to consumers for £7,250. HPI and Experian checks did not reveal its write-off history.

2017 Honda Jazz 1.3 i-VTEC EX

Auctioned as a write-offThis Honda Jazz was auctioned as a Cat S write-off in May 2018 with significant front-end damage.

On sale 10 months laterBy March 2019 this Jazz had been repaired and was advertised for sale to consumers for £10,950 and Experian checks did not reveal its write-off history.

2016 BMW M4 3.0 Competition Pack

Auctioned as a write-offThis M4 was auctioned as a Cat S write-off in April 2018 with significant damage to its undercarriage.

On sale a year laterBy March 2019 this M4 had been repaired and was advertised for sale to consumers for £35,472. HPI and Experian checks did not reveal its write-off history.

How do vehicle history checks work?

Experian AutoCheck and HPI – the two biggest players in the business – told us that they exclusively rely on the Motor Insurance Anti Fraud & Theft Register, or MIAFTR, to determine if a car has been written off.

MIAFTR is a nationwide database run by the Motor Insurers’ Bureau (MIB), and 97 per cent of insurance companies subscribe to it. When an insurer writes off a vehicle, those subscribing to MIAFTR place it on the Register as a write-off. Some history-check businesses outsource to these two companies. The AA relies on HPI data, for example, while the RAC uses Experian.

1. MIAFTR is non-mandatory, and not all insurers use it

It is a legal requirement for insurers to inform the Driver and Vehicle Licensing Agency (DVLA) when a car is written off, but it is not a requirement for them to use MIAFTR to do so – MIAFTR acts as an electronic funnel, automatically informing the DVLA of write-offs, assuming these are uploaded to MIAFTR.

The MIB told us that “97 per cent of the motor insurance market currently subscribe to the MIAFTR database to load the details of their written-off vehicles”. There are 203 UK motor insurance companies authorised by the Bank of England, meaning six do not use MIAFTR; cars written off by these six insurers are unlikely to be detected by history checks.

2. Third-party-only insurance

The MIB suggested that a car may not be detected as a write-off “if the vehicle is not comprehensively insured”. Because third-party insurance does not pay out for damage sustained to the insured vehicle itself, such cars will not have been declared a total loss by the insurer, so may not be on MIAFTR.

3. Delays in updating MIAFTR

The Motor Insurers’ Bureau told us some insurance firms “load manually or in batches” when placing cars on MIAFTR, creating potential delays. Some of the cars we analysed were auctioned as write-offs more than a year ago and were still not detected by the history checks we ran, though.

Furthermore, data obtained via a Freedom of Information request shows the DVLA was informed of 7,676 Cat D and Cat C cars in the 2018 calendar year – even though Cat D and Cat C write-off classifications were replaced by Cat S and Cat N in October 2017.

This means that vehicles placed on the DVLA’s database as Cat C and Cat D in 2018 must have been assessed as write-offs the previous year under the old classifications, with a delay of at least three months.

4. Weak legislation

Legally, insurers must inform the DVLA when a car is written off, but the MIB says “there is no mandated timeframe for supplying write-off data to the DVLA”, creating potential delays even in the official database. The closure of the Vehicle identity Check (VIC) scheme in October 2015 could also have a part to play.

The VIC scheme saw a ‘marker’ placed against Cat C cars (now Cat S) on the DVLA database. These cars had to pass a VIC test, where an inspector would assess them before the DVLA would remove the marker and issue a new V5C logbook. The VIC test didn’t assess the quality of repairs, but if inspectors noticed a “serious defect which would make the car dangerous”, they would issue a prohibition notice, and the car could not be driven. Cat S write-offs now only need to pass an MoT test before being put on the road.

5. Paper-based write-offs

Further DVLA data obtained via a Freedom of Information request reveals that 4,870 vehicles were written off via paper notifications over the past five calendar years. These cars bypassed MIAFTR when being placed on the DVLA’s database, so would be unlikely to show up in checks.

6. History checks relying solely on MIAFTR to check for write-offs

MIAFTR is non-mandatory, subject to delays and may not hold records for written-off cars that only had third-party insurance. So for history-checking firms to rely solely on its data to determine a car’s write-off status is problematic.

How widespread is the problem?

| Write-off category | No. vehicles on MIAFTR | No. vehicles on DVLA database | Difference between MIAFTR & DVLA | No. vehicles on MIAFTR | No. vehicles on DVLA database | Difference between MIAFTR & DVLA |

| 2016/17 | 2016/17 | 2016/17 | 2017/18 | 2017/18 | 2017/18 | |

| Cat A | 8,926 | 8,851 | 75 | 9,502 | 9,370 | 132 |

| Cat B | 105,805 | 115,325 | -9,520 | 109,417 | 119,559 | -10,142 |

| Cat C | 325,324 | 367,093 | -41,769 | 152,084 | 177,089 | -25,005 |

| Cat D | 166,718 | 211,100 | -44,382 | 83,783 | 110,407 | -26,624 |

| Cat S | 343 | 0 | 343 | 101,798 | 123,579 | -21,781 |

| Cat N | 432 | 0 | 432 | 140,694 | 148,431 | -7,737 |

| Total | 607,548 | 702,369 | -94,821 | 597,278 | 688,435 | -91,156 |

Auto Express obtained data from the DVLA showing how many write-off ‘transactions’ the agency processed during financial years 2016/17, and 2017/18. The MIB provided us with the number of write-offs it held records for over the same periods. Data from both organisations is for vehicles, so includes trucks, vans and motorbikes, as well as cars.

There is a significant difference between the two organisations’ databases, with nearly 100,000 fewer written-off vehicles a year appearing on MIAFTR compared with DVLA records. Even after removing from the equation Cat A and B vehicles – which must be scrapped and can never be driven again – these numbers give a clear idea of the discrepancies between MIAFTR and the DVLA’s database.

What do the organisations involved say?

We sent HPI and Experian details of three sample cars that were previously written off but passed their history checks. HPI consumer director Fernando Garcia told us: “Where third- party data is found to be inaccurate or factually incorrect, HPI will work with these partners to ensure that consumer safety remains the main priority and is not compromised in any way.”

Stressing that HPI “constantly monitors the quality of the data it generates and receives”, Garcia said: “If the consumer conducts an HPI Check and it did not show the Vehicle Condition Alert Register information, they would be covered by our guarantee if they adhere to our terms and conditions.”

An Experian spokesperson said the company understands “the cause for concern with the three vehicles highlighted”. Experian explained that it uses MIAFTR “to check whether a vehicle has been marked as ‘written off’ by an insurer”, but that “as none of the three vehicles were recorded as a total loss, they did not show as ‘written off’ on the vehicles’ provenance reports. We will continue to work with our data and insurance industry partners to establish the circumstances behind these three vehicles”.

The Motor Insurers’ Bureau, the organisation that runs MIAFTR, added that “Cat S write-offs will receive a V5C document from DVLA... [that] should alert keepers to the status of the vehicle”. The MIB also stressed that “CAT S and N vehicles can be repaired and legally driven again”.

The DVLA simply said: “Insurance companies are required to notify DVLA of all accident-damaged vehicles.”

What are the potential consequences for car buyers?

Safety

It is impossible to tell from photos how well these cars were repaired after their accidents, but buyers of Cat S and Cat N vehicles are typically advised to commission an independent mechanical inspection before making a purchase – a course of action far less likely with a car believed not to be a write-off.

Financial loss

Cars that have been written off are worth significantly less than their non-write-off counterparts. Anyone who bought a car at standard market value and subsequently finds out it was declared Cat S or Cat N stands to make a substantial loss when they sell it on, assuming its true history is subsequently detected in history checks, or the owner finds out it was written off. It is an offence to knowingly sell a written-off car without declaring its write-off status.

How can buyers protect themselves?

The majority of written-off cars are loaded onto MIAFTR and picked up by history-checking companies, but our investigation will undoubtedly raise concerns among second-hand car buyers. Consumers seeking additional reassurances could consider paying for a mechanical inspection, which should determine whether a car was repaired following a serious accident.

Buyers are also offered some protection by a history-check guarantee. Both HPI and Experian AutoCheck will pay up to £30,000 to ensure buyers do not suffer financial losses as a result of their checks – although terms and conditions apply to these guarantees.

A third option is to make use of www.vcheck.uk, where you can get a basic check against salvage records for free.

What do you think of the insurance write-off scandal? Let us know in the comments section...