The future of DS: can three cars and new boss save the French flop?

The posh French brand thinks new No8 EV could be key to the sales growth that has eluded it so far. We meet DS executives to find out more...

“Today DS is far away from the likes of Audi, but you need to start the dream,” then-CEO Carlos Tavares told us over a Parisian lunch in 2014. “Anybody trying to compete in the premium area thinks they need to fight the Germans with the same weapons. I won’t do that because I will lose.

“We want to convey the French touch, sophistication and trendiness in our new DS models; the French way of life, everything that makes the Brits come to France for their holidays. DS is a fashionable brand. This is unique to us.”

Carlos Tavares was the hotshot leader who dragged Peugeot and Citroen from near-bankruptcy to profitability, and had the vision to take DS from Citroen sub-brand to standalone French premium marque. His ambition was clear: with Chanel, Louis Vuitton and Hermès world leaders in luxury accessories and fashion, why couldn’t the French carve a similar niche in premium cars, introducing avant-garde design where the Germans offered conservatism and comfort instead of sportiness, underpinned by exceptional customer service?

The struggle for sales

Fast forward to 2025 and the DS brand has its fourth CEO in a decade, Xavier Peugeot. European registrations are down almost 21 per cent this year to just 20,784 cars – less than half the volume of minnows Alfa Romeo and Lexus. Indeed since DS launched its first bespoke car, the DS 7 Crossback in 2017, the brand has never topped 50,000 registrations in Europe. And Chinese sales have evaporated as that market has embraced domestic EVs.

Under the leadership of the former Citroen product director and member of the founding Peugeot family, DS is priming itself for another premium push. The No8 – a pure-electric crossover – is the flagship car, flanked by the No4, a facelifted and rebadged version of the family hatchback launched in 2021. Note the new naming convention, a la Chanel perfume. A third model, expected to replace the 7 Crossback, is due to be launched next year.

“There is a momentum, which is very exciting for DS, with three launches in 18 months,” says Xavier Peugeot, at a meeting with Auto Express at the British Motor Museum. He’s here with his French heads of sales and product development, plus UK managing director Jules Tilstone, to present the new range to investors, including representatives of the 27 retailers who registered 1,152 cars in 2024. Between them.

“We do not deny that our sales were down in 2024,” Peugeot tells Auto Express. “To me, 2024 and 2025 are transition years. The car market is highly competitive [and] you need to feed your product range on a very regular basis, [otherwise] you are immediately impacted.”

The No8 is DS’s first all-new car since 2021. That is damning, with the DS 7 and now seven-year-old DS 3 compact SUV left to age, and new model introductions slowed: the pure electric version of the DS 4 is now arriving more than a year late, for example. But it’s hard to prioritise investment in DS when the Stellantis autos group has 13 other brands, many with a more convincing chance of delivering a bigger return faster than the French manufacturer.

“DS is a profitable brand,” counters Xavier Peugeot. “And we’ll go into next year with some incredibly powerful tools that we didn't have going into 2025.”

Carlos Tavares left Stellantis almost a year ago, but not before making ambiguous comments that loss-making brands could face awkward questions. But Peugeot vows the question of DS’s closure is “not on the table”, because of Stellantis’ otherwise limited access to the premium market, which he claims represents one quarter of European volume and nearly 40 per cent of the profits.

“Should we stop a brand bringing profitable results to the company in a premium segment, which is impactful for the car market?” DS’s chief executive officer asks.

Peugeot refuses to be drawn by our requests to outline why DS has not gained a foothold outside of France, which tends to back its homegrown brands. The fundamentals of DS cars remain the same as a decade ago: a comfortable ride and groundbreaking tech inspired by the hydropneumatic suspension and swivelling headlamps of the original DS19 from 1955, beneath avant-garde design. But the first DS launches did not live up to this billing, a notion laid bare by comparing the original DS 7 Crossback with the new No8.

The 2017 SUV had a timid, faux-Audi exterior design, an imaginative interior let down by wobbly quality, and lacklustre drivetrains; the new flagship looks bold and distinctive, with its illuminated grille, optional two-tone bonnet, modernist surfacing and sloping roofline. After 10 years, DS has finally delivered something eye-catching and compelling. Auto Express’s review praises the ride comfort, and commends the interior as “feeling and looking brilliant”.

DS has always been a strong advocate of electrification, starting with plug-in hybrids, the pure-electric DS 3 and racing in Formula E, with the intent to launch only electric cars from 2024. But electric vehicle leadership poses risks with lower sales, as Porsche has discovered: the No8, like the new Macan, was conceived solely with an electric drivetrain, although DS’s STLA Medium vehicle architecture does support hybrids if the firm goes back to the drawing board.

Technological prowess

DS wants to showcase its tech prowess with one of the largest ranges on the market: 465 miles. Peugeot reckons the No8 will travel from Birmingham to Edinburgh – almost 300 miles – without needing a charge. “No8 is the halo,” he says. “We all know that a strong, distinctive product can have a big impact on cutting through.”

And the lack of cars on the road has hampered consumer awareness. “Clearly, we've got a job to do in breaking through as an independent brand, particularly unprompted awareness,” admits UK boss Jules Tilstone. “Getting DS on people’s shopping lists is a job still to be done.”

Used values, which dictate leasing rates, are critical, and the DS 3 and discontinued DS 9 drop huge chunks of their worth. Tilstone says the No8 counters this with “class-leading” residuals. Used values are a strength of German rivals, alongside broad model ranges, extensive dealer networks, compelling finance offers and aspirational brands.

“If you look at the market share from the top three German brands this year, they're down 2.5 points in the UK,” argues Tilstone. “Newcomers are cutting through. The dynamic is changing and we’re here to take full advantage.”

So what are Xavier Peugeot’s expectations? “We sold 55,000 cars in DS’s best years since launch. We need to ensure that this maximum level of worldwide sales becomes the minimum level in future. And if I was to tell you I’d like to triple that, you would call me crazy!”

“The coming launches will be key to the success of DS in the UK. This is why we had this dedicated dealer session today, sharing our roadmap and giving some concrete answers to convince them there is a way forward.”

Peugeot says DS should not be judged through volumes – just as Tavares did. “This is a 20 to 30-year story,” he told us back in 2014. Maybe – but the next three years will be pivotal.

DS goes slow, but why has Cupra thrived?

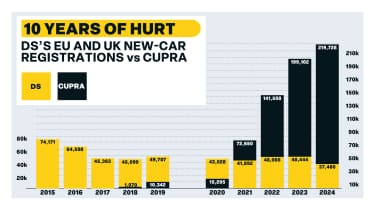

Cupra sold just under one-third of DS Automobiles’ European volume in 2020; four years later, SEAT’s start-up premium brand registered almost six times as many cars. Why?

It’s down to product and positioning. While DS targeted old-school premium with big cars such as the DS 7 and DS 9 (for Chinese saloon buyers), Cupra went for the heart of Europe’s biggest market, the mid-size SUV.

The Cupra Formentor was launched in 2020, and looked fresh with its jacked-up estate bodystyle covered in trendy matt paint and copper-coloured accents.

Most importantly it cut through, giving the brand visibility and momentum. Subsequent launches – the Tavascan EV and combustion-engined Terramar – also doubled down on mid-size crossovers

with swoopy, aggressive designs.

New chief executive officer Markus Haupt chuckles at the memory of the SEAT team pitching Cupra to the Volkswagen Group executives in 2018. “People were saying ‘these guys are completely crazy!’. But the designs are spectacular, we built up on very good VW Group platforms, and it’s the ecosystem around the brand and the cars,” the CEO explained.

Ecosystem? Cupras are pitched at young urbanites, with ‘City Garages’ that put a twist on the typical retailer, hosting gigs, DJ nights and artistic events to incentivise joining the ‘tribe’ and building the brand’s cultural capital. It hasn’t hurt that Cupra has mined its hometown link with Barcelona FC, and sponsors padel, the mash-up of tennis and squash that is growing in UK popularity as dramatically as Cupra.

Haupt claims his customers’ average age is 43, and the brand has just built its one-millionth car. Plus the all-new models will reach a fifth car in 2026, when the electric Raval small hatchback joins the party.

Cupra focuses on design just like DS does, but it’s executed in a more dynamic way, with performance sitting at the heart of each model. Sadly for DS, that appears to be the quicker route to market success. After all, consumers like to think of themselves as sporty, youthful and trendy – even when they’re not.

Click here for our list of the best executive cars...